fidelity tax free bond fund by state 2020

The Fund seeks to provide a high current yield exempt from federal income tax by investing in investment-grade municipal debt securities. See Fidelity SAI Tax-Free Bond Fund performance holdings fees.

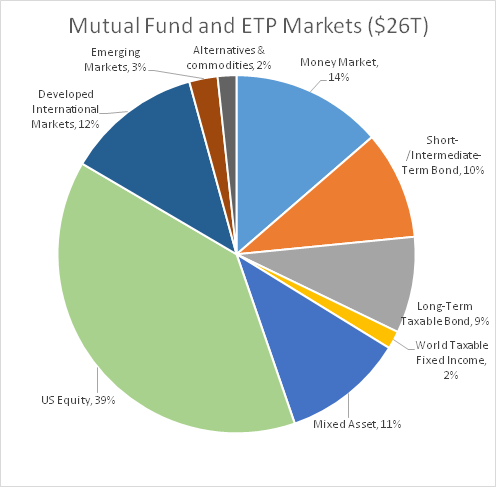

Spy Composition It S Growthy Financial Statement Analysis Real Estate Investment Trust Stock Market

Find the latest Fidelity Tax-Free Bond FTABX.

. Best tax-free municipal bond. Fidelity calculates and reports the portion of tax-exempt interest dividend. Municipal bonds are free from federal taxes and are.

Income that may be exempt from your. Ad High-Rated Muni Bond Strategies. And the funds managers have brought in a 209 one-year total return a 602 three-year total return and a 482 five-year total return.

Taxes by State Solving Tax Issues More. Fidelity Professionals Are Here to Help You Determine Your Retirement Plan Goals. Fidelity Professionals Are Here to Help You Determine Your Retirement Plan Goals.

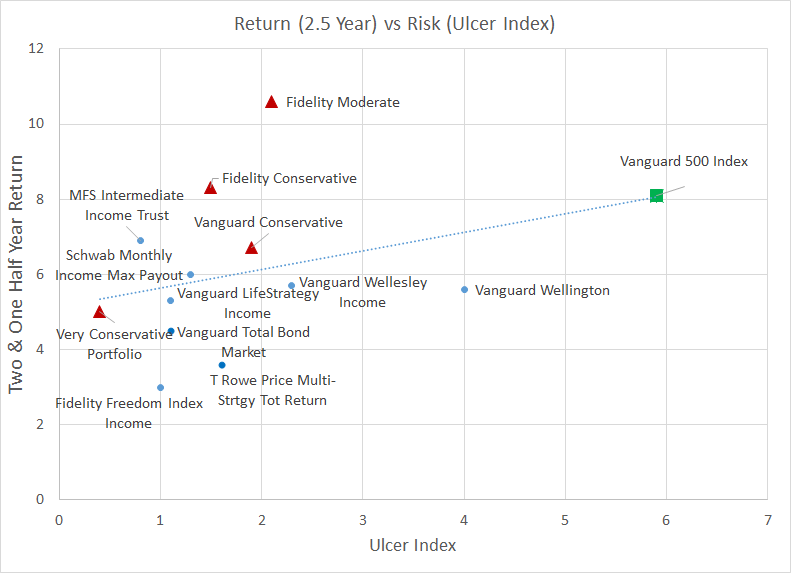

This Fund is managed to have an. Click here for Fidelity Advisor mutual fund information. As of July 19 2022 the fund has assets totaling almost 308 billion invested in 1184 different holdings.

Its portfolio consists of municipal. Ad Seek More From Municipal Bond Funds. Ad Our ETFs Provide Access To Professionally Managed Investment Strategies.

Fidelity Tax-Free Bond has found its stride. Our Curated Customizable Education Resources Can Help You Become a Smarter Investor. Learn About The Tax-Exempt Bond Fund of America.

XNAS quote with Morningstars data and independent analysis. Learn More About Our Brand New ETFs For Your Clients Opportunities. Find The Best Muni Bond Fund Here For Tax Advantaged Income Potential In Any Market.

Ad See How Fidelity Could Help You Meet Your Goals And Save For Tomorrow. Stay up to date with the current NAV star rating. L Fidelity Tax-Free Bond Fund is a diversified national municipal bond strategy investing in general obligation and revenue-backed municipal securities across the yield curve.

See Fidelity SAI Tax-Free Bond Fund FSAJX mutual fund ratings from all the top fund analysts in one place. Mutual Funds And Separately Managed Accounts Available. Explore Our Range of Tax-Exempt Bond Funds and Models.

The fund is free from both federal income tax from the alternative minimum tax. Ad See How Fidelity Could Help You Meet Your Goals And Save For Tomorrow. Ad Take a Risk-Managed Approach to Income In a Yield-Starved World with BlackRocks MAYHX.

Market Watch 2021 The Bond Market Fidelity

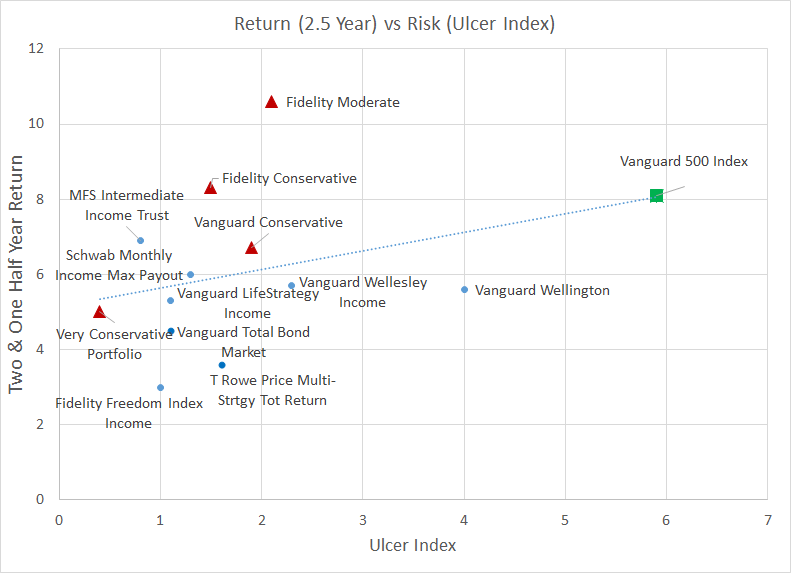

Mutual Fund Observer July 2020 Update Seeking Alpha

Retirement Strategy Where I Am Stashing More Cash Fbndx Mutf Fbndx Seeking Alpha

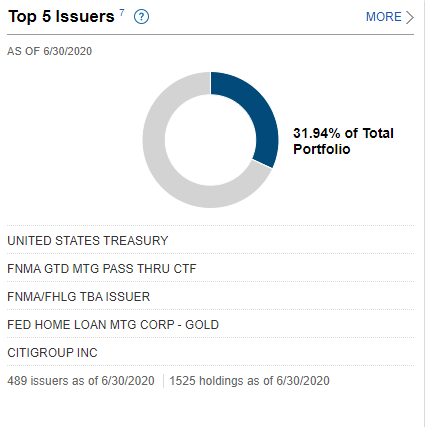

Fidelity Financial Advisor Services Review 2022 Moneyrates

7 Of The Best Fidelity Bond Funds To Buy

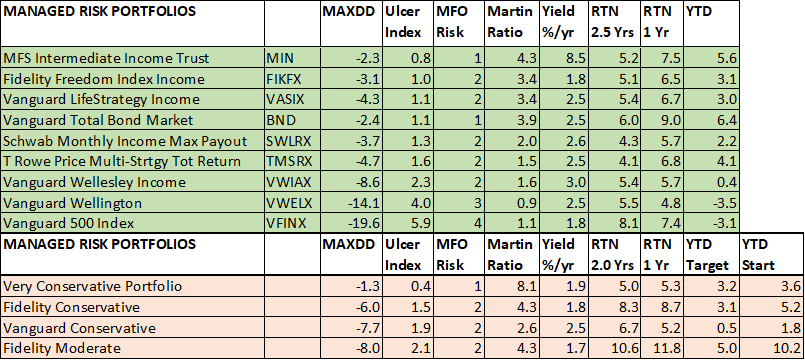

Diversifying In 2020 Using Momentum And Risk Management Seeking Alpha

How Do I Determine The Exempt Interest Dividends From Multiple States In A High Yield Tax Exempt Vanguard Fund

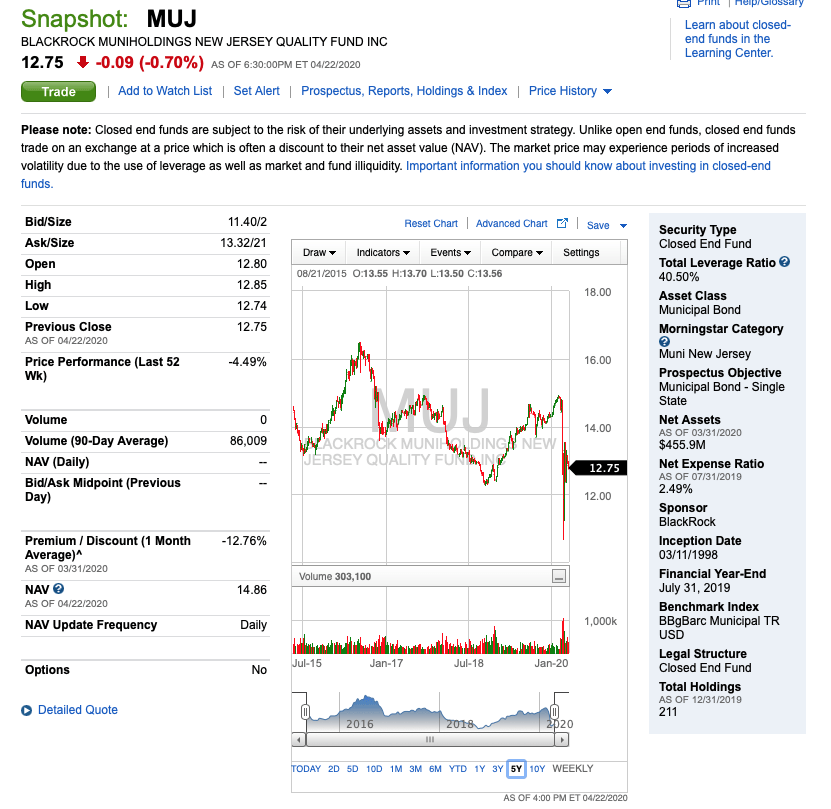

Blackrock Nj Cef 14 Discount To Nav And 7 25 Taxable Equivalent Yield Nyse Muj Seeking Alpha

Mutual Fund Observer July 2020 Update Seeking Alpha

/Fidelityvs.T.RowePrice-5c61be6e46e0fb000110647b.png)

Fidelity Investments Vs T Rowe Price

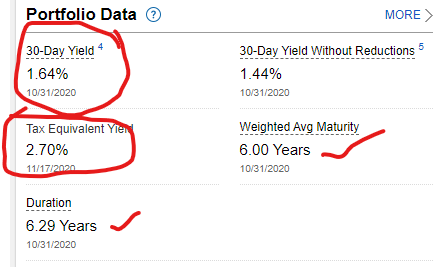

Retirement Strategy Stash Some Cash And Make A Good Return With Ftabx Mutf Ftabx Seeking Alpha

7 Of The Best Fidelity Bond Funds To Buy

There S More To Value Investing Than Low Prices Morningstar Value Investing Investing Ishares

Familiar Themes Dominate October U S Fund Flows Morningstar Fund Management Bond Funds Fund

:max_bytes(150000):strip_icc()/Untitled-72f62d8eef3c4d358da00b4c45645f34.jpg)